Ratchets in Management Incentive Plans

Ratchets are a common feature of Management Incentive Plans (MIPs) in private equity–backed structures, designed to align the interests of management teams with those of financial sponsors by linking a proportion of management’s equity participation to the achievement of defined investor return thresholds.

By adjusting the allocation of equity upside as performance hurdles are met, ratchets serve as a mechanism to reward management for delivering superior returns while preserving investor protections in downside scenarios. The design and implementation of ratchet arrangements require rigorous attention to structural, tax, and valuation considerations. A well-structured ratchet therefore not only promotes alignment and performance but also mitigates unintended complexities that may arise.

What is a ratchet?

A ratchet is a mechanism in a management incentive plan (“MIP”) where the MIP pot is increased subject to the private equity investor achieving certain pre-determined level of returns. The investors’ level of returns (or performance hurdles) are typically based on a multiple of money (MoM) (e.g. 2.5x of the invested amount) or/and the investor’s annualised return, i.e. internal rate of return (IRR)

Why are they used?

Ratchets incentivise management teams by rewarding outperformance. They can also help to bridge the gap between management's and the Investor’s expectations of the business performance.

Types of ratchets

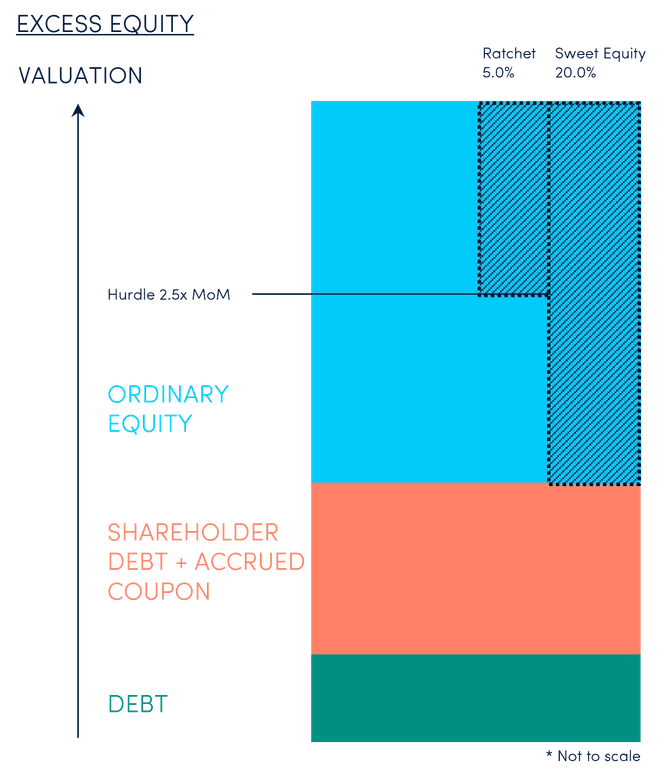

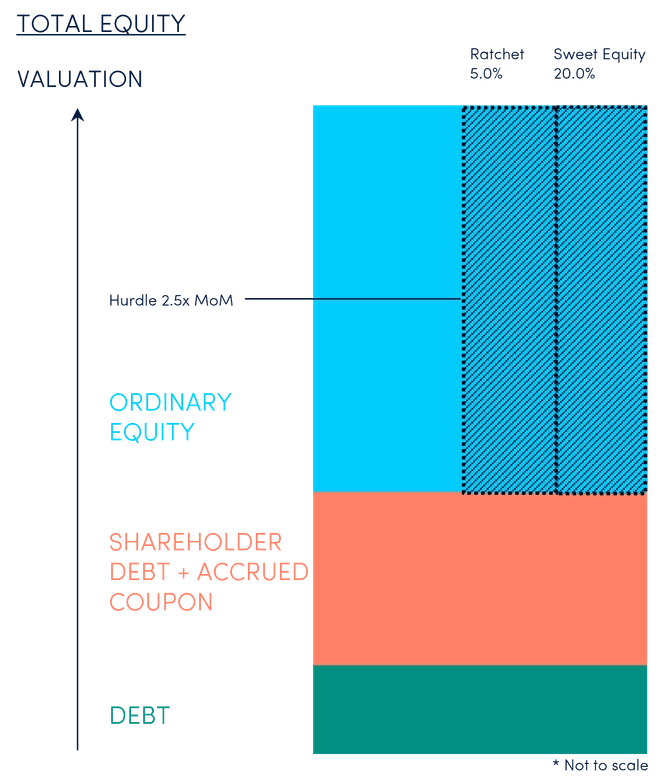

The most common form of ratchets in the market are either ‘excess equity’ or ‘total equity’ (although there are structures with variation of these):

- Excess equity ratchet: The increase in the MIP pot applies only to the ordinary equity value in excess of the performance hurdle, e.g. the MIP pot is increased by 5% of the ordinary equity value in excess of valuation where the investor receives a 2.5x MoM return.

- Total equity ratchet: The increase in the MIP pot applies to the total ordinary equity value once the performance hurdle is met, e.g. the MIP pot is increased by 5% of the total ordinary equity value where the investor receives a 2.5x MoM return.

Other key considerations

- When setting up ratchets, there are tax valuation considerations that needs to be accounted for, to support the treatment of the ratchets gain as capital rather than employment income.

- Follow-on funding from the investor and M&A could impact the calculation of the ratchets

- Most importantly, in order to drive the right behaviour, the management team needs to understand the potential value of the ratchets, otherwise the benefit is lost on them. This is not always straightforward to convey given the nuances in the conditions and calculations.

Liberty Corporate Finance can help companies with the implementation of ratchets and communication of their potential value to the management team.